Fixed Exchange Rates in SAP Purchase Orders:

For businesses operating globally, managing currency fluctuations is a critical aspect of procurement. SAP Purchase Orders (POs) offer robust features to handle these fluctuations, including the ability to utilize fixed exchange rates. This blog delves into the “fixed exchange rate indicator” within SAP POs and its practical implications.

Understanding the Need for Fixed Exchange Rates in Procurement

When creating a purchase order with a foreign vendor, the exchange rate used to convert the purchase price into your local currency can significantly impact your costs. Fluctuations between the PO creation date and the invoice receipt date can lead to discrepancies and unexpected expenses.

Using a fixed exchange rate in SAP POs allows you to:

- Lock in a specific exchange rate: This provides cost certainty and predictability, preventing surprises due to market volatility.

- Simplify financial planning: By knowing the exact local currency equivalent, you can accurately budget and forecast expenses.

- Streamline invoice verification: Matching invoices becomes easier when the exchange rate is predetermined.

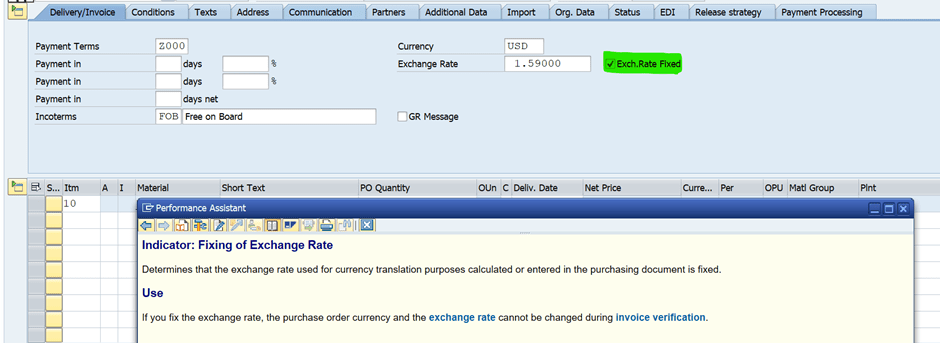

The Fixed Exchange Rate Indicator in SAP POs

Within SAP POs, the “fixed exchange rate indicator” is a field that allows you to specify that the exchange rate used at the time of PO creation should be maintained throughout the procurement process.

Here’s how it generally works:

- PO Creation: When creating a PO with a foreign vendor, you enter the currency and the exchange rate.

- Fixed Exchange Rate Indicator: You activate the fixed exchange rate indicator.

- System Behavior: SAP stores the exchange rate from the PO. When the invoice is received, the system uses this stored rate, regardless of the current market rate.

- Invoice Verification: During invoice verification, the system uses the fixed rate to calculate the local currency amount.

Practical Considerations and Best Practices

- When to Use It:

- Use fixed rates when dealing with high-value purchases or when cost certainty is paramount.

- Consider using it when market volatility is expected.

- For long term purchase orders, or contract based purchase orders.

- Setting the Exchange Rate:

- Ensure the exchange rate used is accurate and reflects the agreed-upon terms with the vendor.

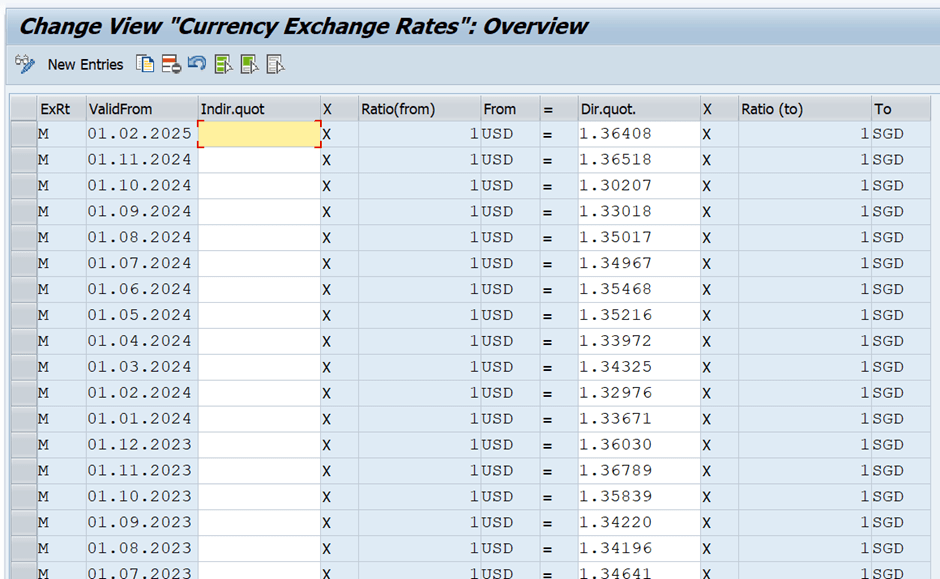

- Consider using a reputable source for exchange rate data.

- Master Data:

- Maintain accurate vendor master data, including the currency.

- Ensure the exchange rate type used in the purchase order is the correct one.

- System Configuration:

- Verify that your SAP system is configured correctly to handle exchange rates.

- Ensure that the correct exchange rate type is configured.

- Communication with Vendors:

- Clearly communicate the use of a fixed exchange rate to your vendors to avoid misunderstandings.

- Monitoring and Reconciliation:

- Regularly monitor exchange rate fluctuations and reconcile any discrepancies.

- Run reports to find PO’s with fixed exchange rates.

Benefits of Using Fixed Exchange Rates in SAP POs

- Improved cost control and predictability.

- Reduced financial risk.

- Simplified invoice verification.

- Streamlined procurement processes.

Potential Challenges

- If market rates move significantly in your favor, you may miss out on potential cost savings.

- Requires careful monitoring and communication.

- Possible complications if the invoice is delayed for a long period of time.

Case 1- Exchange Rate Fixed = X: In this case, the exchange rate in Purchase Order will be fetched automatically during Goods Receipt and Invoice Receipt. This needs to be done as per the business requirement whether they want to use the PO exchange rate till the completion of entire PO or not.

Case 2- Exchange Rate Fixed =: In this case, the exchange rate during Goods Receipt and Invoice Receipt will be fetched from OB08 transaction but not from the Purchase Order. Based on the requirement, business can decide.

Conclusion

The fixed exchange rate indicator in SAP POs is a valuable tool for managing currency risk and ensuring cost certainty in global procurement. By understanding its functionality and implementing best practices, businesses can leverage this feature to optimize their procurement processes and improve financial performance.

Best Regards,

Ganesh Padala